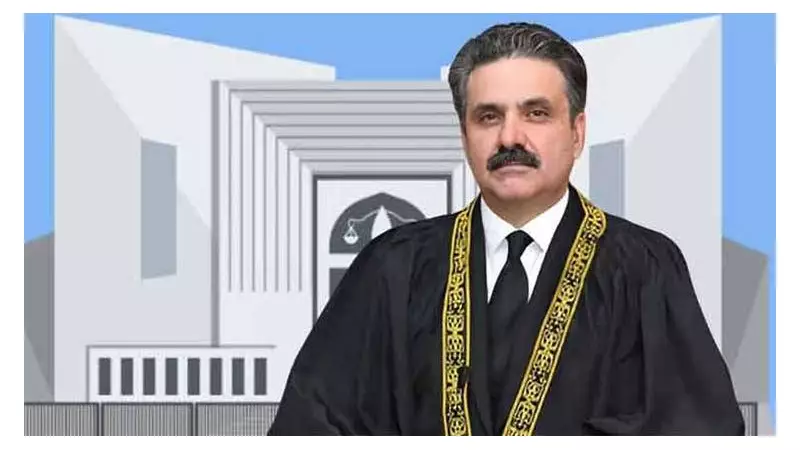

Chief Justice of Pakistan (CJP) Qazi Faez Isa has made a firm commitment to accelerate the resolution of tax-related cases currently pending within the country's judicial system. The top judge emphasized that the swift disposal of such litigation is not merely a procedural matter but a critical necessity for stabilizing and strengthening Pakistan's national economy.

A Judicial Priority for Economic Stability

Justice Isa issued this directive while presiding over a three-member Supreme Court bench. The bench was hearing a significant case concerning the Federal Board of Revenue's (FBR) appeal against a Lahore High Court verdict. The underlying dispute involved a private company and a substantial tax demand of approximately Rs 360 million.

The CJP's remarks underscored a clear understanding of the intersection between law and economics. He pointed out that prolonged legal battles over tax liabilities create uncertainty, hinder government revenue collection, and ultimately place a burden on the state's financial resources. By prioritizing these cases, the Supreme Court aims to inject certainty and efficiency into a system that directly affects fiscal policy.

The Case at Hand: A Rs 360 Million Tax Dispute

The specific hearing that prompted the CJP's statement centered on an FBR appeal. The revenue authority was challenging a Lahore High Court decision that had ruled in favor of M/s ICI Pakistan Limited (now part of the Yunus Brothers Group) regarding a tax assessment.

During the proceedings, the CJP engaged directly with the FBR's counsel, questioning the rationale behind the prolonged litigation. He inquired whether the disputed tax amount had already been deposited with the government. Upon learning that the Rs 360 million was still pending, Justice Isa stressed the importance of resolving such high-value matters promptly to unlock funds for national use.

In a decisive move, the Supreme Court dismissed the FBR's appeal and upheld the Lahore High Court's judgment. The top court also imposed a cost of Rs 100,000 on the FBR, directing that this penalty be deposited into the Supreme Court's account dedicated to providing legal aid to the underprivileged.

Broader Implications for Revenue and Governance

This stance by the Chief Justice sends a powerful message to all stakeholders, including the tax machinery and corporate entities. It signals the judiciary's intent to clear bottlenecks that impede revenue flow to the national exchequer. The accumulation of unresolved tax cases represents billions of rupees in potential state revenue that remains stuck in legal limbo.

Legal experts suggest that this judicial push could encourage the FBR to strengthen its case preparation and internal assessment processes to avoid frivolous or weak litigation. Simultaneously, it assures businesses of a more predictable and timely resolution of tax disputes, which is a positive signal for the investment climate.

The CJP's vow is seen as a step towards judicial activism in the service of economic governance. By fast-tracking cases that have a macro-economic impact, the Supreme Court is positioning itself as a facilitator of economic stability, ensuring that legal processes do not inadvertently exacerbate fiscal challenges.

The commitment to swift disposal is expected to have a ripple effect, potentially motivating high courts and appellate tribunals across the country to similarly prioritize substantial tax-related appeals. This coordinated effort could significantly reduce the backlog of cases that directly affect the government's financial health and its ability to fund public services and development projects.