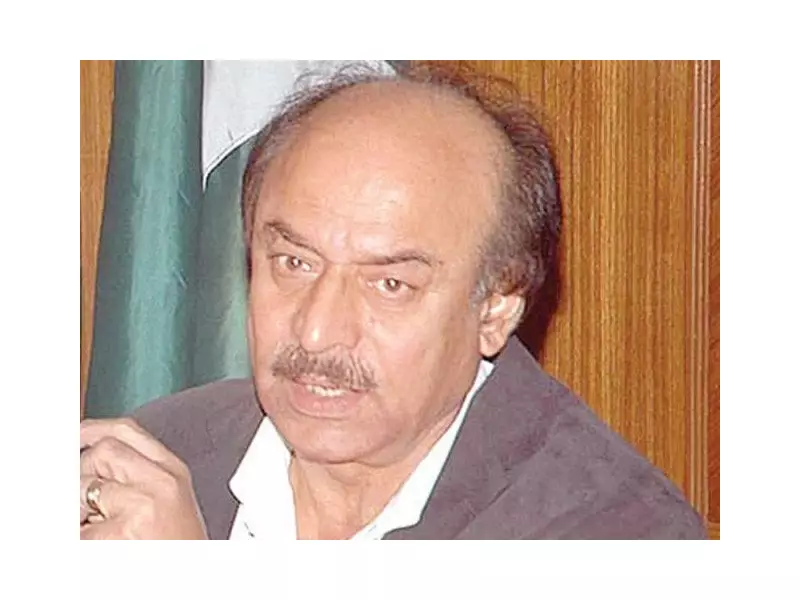

HYDERABAD: In a strong statement, the Chairman of the Sindh Assembly's Public Accounts Committee (PAC), Nisar Ahmed Khuhro, has declared that provinces must not face penalties for the Federal Board of Revenue's (FBR) failures in collecting taxes. He firmly rejected any move to reduce the National Finance Commission (NFC) award based on poor tax recovery.

Strong Opposition to NFC Award Reduction

Addressing a Pakistan Peoples Party (PPP) gathering in Shikarpur district, Larkana division, on Saturday, Khuhro took a clear stand. He argued that the constitutional framework does not allow for a decrease in the provinces' financial share. Khuhro reminded the PML-N-led federal government that while the constitution permits an increase in the NFC share, the law explicitly prohibits any curtailment. He pledged that the PPP would staunchly defend this provincial right, which is protected under the landmark 18th Constitutional Amendment.

A Bold Proposal: Delegate Tax Powers to Sindh

Instead of punishing the provinces, Khuhro presented an alternative solution to the centre's revenue woes. He proposed that if the FBR is struggling with tax collection, the federal government should delegate the authority to collect taxes on services and goods to Sindh. He assured that the province has the capability and would return any additional revenue collected to the federal coffers.

Khuhro backed his proposal by highlighting the proven track record of the Sindh Revenue Board (SRB). He pointed out that the SRB is already a high-performing institution, successfully recovering over Rs300 billion annually from the province. This demonstrated competence, he stressed, makes the SRB fully capable of taking on a larger role as a substitute for the FBR in Sindh.

Defending Provincial Rights and Financial Autonomy

The PAC chairman's remarks underscore a growing tension between the centre and the provinces over fiscal resources. His statement is a direct defense of provincial financial autonomy guaranteed by the 18th Amendment. Khuhro's argument centers on the principle that the failure of a federal institution should not lead to a financial disadvantage for the provinces. By suggesting a practical transfer of collection authority, he positions Sindh as a willing and able partner in enhancing national revenue, provided its constitutional share remains untouched.

The proposal sets the stage for a significant political and financial debate, challenging the federal government to consider decentralizing tax collection as a solution to improving Pakistan's revenue performance.